French President Macron Meets with Chinese Foreign Minister

China's Railway System Exceeds 300 Million Passengers During Spring Festival Travel Rush | Chinese Stock Market in Reform

Hello from Shanghai, China. Here’s our pick for today’s news:

French President Macron Meets with Chinese Foreign Minister

China's Railway System Exceeds 300 Million Passengers During Spring Festival Travel Rush

Chinese Stock Market in Reform

1. French President Macron Meets with Chinese Foreign Minister

On 20 February, French President Emmanuel Macron held talks in Paris with Wang Yi, member of the Political Bureau of the Communist Party of China (CPC) Central Committee and Chinese Foreign Minister.

Macron stressed the importance of the France-China strategic dialogue and reaffirmed France's consistent adherence to the one-China policy, stating that this position is clear and unambiguous. In the face of global challenges, France is committed to strategic autonomy and is willing to enhance strategic cooperation with China to jointly safeguard peace and stability.

Both sides agreed to strengthen cooperation on a wide range of issues, including climate change, biodiversity protection, sustainable development, agricultural products, clean energy, nuclear energy research and development, artificial intelligence, aerospace, and forest carbon sinks.

2. China's Railway System Exceeds 300 Million Passengers During Spring Festival Travel Rush

A recent report by the China National Railway Group announced that the national railway system had carried a total of 300 million passengers by 19 February, since the start of the Spring Festival travel rush on 26 January. On 19 February alone, the railway system carried about 14.03 million passengers.

To meet the growing demand, railway departments across the country have maximized their capacity and increased train services on popular routes and sections. They have also taken effective measures to prevent any disruption caused by the cold weather, while improving service quality to ensure a smooth travel experience for passengers. They have increased guidance and assistance at key points such as platforms, escalators and exit gates to facilitate safe and efficient departures for returning passengers.

The Spring Festival travel rush, also known as Chunyun, is the largest annual human migration in the world. It is a time when millions of Chinese people travel across the country to celebrate the Lunar New Year with their families. The Chinese railway system has played a crucial role in connecting people and facilitating their journeys during this important cultural tradition.

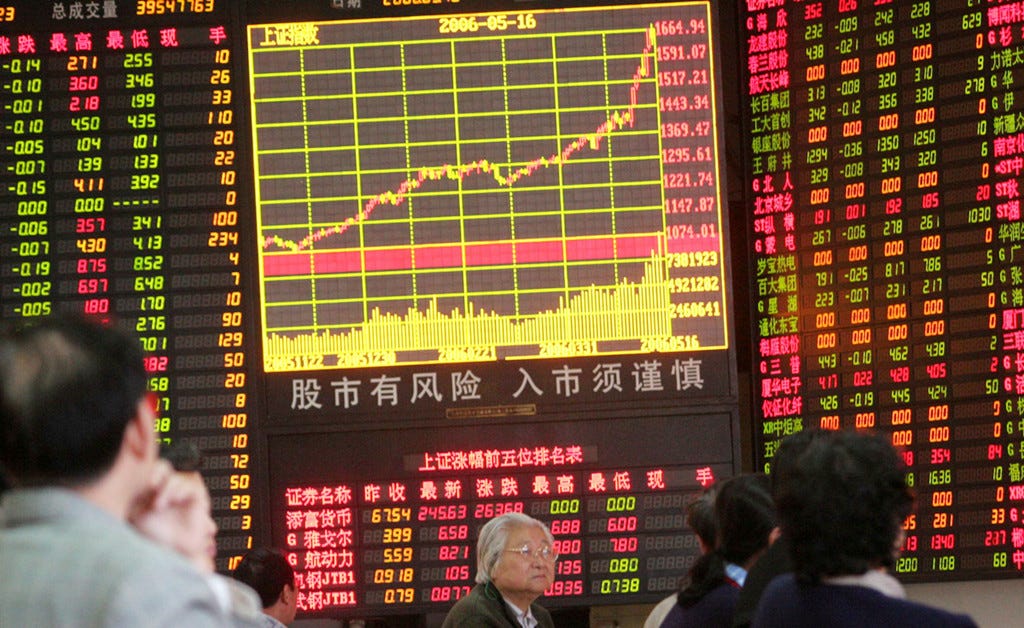

3. Chinese Stock Market in Reform

Lately, Chinese authority has been focusing on the previously little-regulated stock market. After the appointment of the new chairman of the China Securities Regulatory Commission, new sets of regulations and punishments are being carried out swiftly, bringing a powerful momentum to the previously chaotic and speculative market. Here’re some examples of the reform:

Shanghai Stock Exchange Implements New Reporting System for Algorithmic Trading

Back in October 9, 2023, the Shanghai Stock Exchange (SSE) has already established a dedicated reporting system and corresponding regulatory arrangements targeted at quantitative trading by publishing "Notification on Matters Related to the Reporting of Algorithmic Stock Trading" and "Notification on Strengthening the Management of Algorithmic Trading."

The said regulation has just been implemented lately. Now, existing investors have completed their reporting on schedule as required, and new investors have complied with the "report first, trade later" regulation. Overall, the quality of the reports submitted by all parties has met the requirements, laying a solid foundation for the further strengthening and improvement of quantitative trading supervision.

The SSE has committed to leveraging the reported information to continuously enhance the monitoring and analysis of algorithmic trading, especially high-frequency trading. The Exchange will dynamically assess and refine the reporting system to ensure robust regulatory oversight of this advanced and rapidly evolving segment of the trading landscape.

Shanghai, Shenzhen, and Beijing Exchanges Report 46 IPO Applications Withdrawn in Early 2024

As of February 20th this year, data from the stock exchanges in Shanghai, Shenzhen, and Beijing shows that 46 companies have terminated their listing applications. Among these, one application was rejected at the review meeting, while the remaining 45 companies voluntarily withdrew their applications. This move comes as part of an effort to improve the quality of listed companies at the source.

The China Securities Regulatory Commission (CSRC) is set to focus more on strictly controlling the Initial Public Offering (IPO) access, by intensifying supervision and inspection of companies preparing to go public. There is a significant emphasis on clamping down on financial fraud to ensure the integrity of the market.

Market professionals believe that by tightening the scrutiny of IPO admissions and attracting genuinely high-growth and high-tech enterprises to list, the market will become more robust. There is a call for strong measures against companies that aim to list for the purpose of "cash grabbing" and "cashing out." Additionally, there is a push to increase penalties for intermediary agencies involved in cases of wrongdoing. These efforts aim to protect the lawful rights and interests of small and medium investors and to boost market confidence.

Shenzhen Stock Exchange Disciplines Ningbo Lingjun Investment for Abnormal Trading Behavior on February 19

On February 19, the Shenzhen Stock Exchange (SZSE) identified abnormal trading activities executed by Ningbo Lingjun Investment Management Partnership (Limited Partnership), hereinafter referred to as "Ningbo Lingjun." Between 9:30:00 and 9:30:42, several securities accounts under Ningbo Lingjun used computer programs to automatically generate trading orders, placing a large number of orders in a short period, selling a total of 1.372 billion yuan worth of stocks in the Shenzhen market. This activity caused a rapid decline in the Shenzhen Component Index and disrupted the normal trading order, constituting abnormal trading behavior as defined by Article 6.2, Item 6 of the "Shenzhen Securities Exchange Trading Rules."

Throughout the year, Ningbo Lingjun's securities accounts have been subject to regulatory measures such as written warnings from the Exchange due to abnormal trading practices. Despite these measures, Ningbo Lingjun continued to engage in abnormal trading behavior.

In accordance with the "Detailed Rules for Trading Restrictions" and "Measures for Self-Regulatory Supervision and Disciplinary Actions" of the Exchange, the SZSE has decided to impose trading restrictions on the securities accounts associated with Ningbo Lingjun. Starting from February 20, 2024, to February 22, 2024, these accounts will be prohibited from buying and selling any stocks listed on the SZSE. Furthermore, the Exchange has initiated procedures for a public reprimand and disciplinary action against Ningbo Lingjun.