Editor’s Note: China is making headway in its plan to de-risk its economic ties with the West-by October 2024, China’s export dependence on the U.S. has decreased to 14.6%, down 4.4% from 2017. Exports to the EU and Japan have also dropped to 14.6% and 4.3%, respectively, both down 1.8% from 2017. The following article by Li Jianqiu, a well-known current affairs commentator in China, walks you through China’s strategy for diversification, from export markets to foreign currency reserves.

Since Trump announced a 60% tariff on China and later added another 10%, along with a 25% tariff on Canada and Mexico, China’s highly sensitve A-shares seem largely unaffected. Today, A-shares have risen significantly, completely unlike the past when tariffs led to a sharp decline. Life goes on as usual.

Everyone knows that Trump is once again using tariffs as a pretext to pressure other issues, and these so-called “other issues” are often impossible for other countries to fulfill.

For example, demanding that China control fentanyl is an issue that China cannot address; it fundamentally pertains to U.S. domestic problems. Should China send drug enforcement officers to the U.S. to enforce laws? Trump would certainly not allow that.

Similarly, asking Mexico and Canada to manage their borders and stop illegal immigration is ironic, especially since illegal immigrants are already in Canada but still want to enter the U.S. As for Mexico, it’s unfortunate—if it could control the drug lords, it wouldn’t be in its current situation. Trump’s threat to send troops into Mexico to eradicate drug lords is reminiscent of actions taken in the 1980s, which had negligible results.

Other countries cannot manage U.S. affairs, and if Trump cannot handle his own country’s issues, how can he expect others to solve them? It’s laughable.

It’s clear that these actions are merely a performance for his base.

That said, since this situation has arisen, we must look at the long term, regardless of the immediate impact on China.

Goal: Developing Countries

China is currently in a phase of industrial upgrading. When Americans and Europeans claim that China has overcapacity, is it true? Yes, but it’s not Chinese overcapacity; it’s American and European overcapacity.

According to the law of comparative advantage, Americans and Europeans have higher production costs for industrial goods, so they should shift towards services or agriculture. Meanwhile, China has a lower cost of production for industrial goods, which means China should exchange these for products from the service sectors or agricultural products from Europe and America.

Of course, neither Europeans nor Americans are willing to do this.

China is in a phase of industrial transformation. During the first tariff war in 2017, China’s new energy industry was not yet established, and the auto industry was still in its infancy. From 2014 to 2019, domestic criticism of new energy vehicles was rampant, but eventually, this sector yielded significant results.

Additionally, there has been diversification in foreign trade and settlement methods. Since the last trade war, China has undertaken considerable reforms, gradually shifting its trade from the U.S. and Europe to developing countries, ultimately leading to developing countries exporting goods to the U.S. and Europe.

From 2017 to now, measuring China’s export dependence on various countries/regions as a proportion of total exports, by October 2024, China’s export dependence on the U.S. has decreased to 14.6%, down 4.4% from 2017. Exports to the EU and Japan have also dropped to 14.6% and 4.3%, respectively, both down 1.8% from 2017.

Export dependence on countries and regions along the Belt and Road has risen to 45.6%, a significant increase of 17.6% since 2017, with dependence on ASEAN rising to 16.1%, up 3.8% from 2017.

In terms of payment for goods trade, in 2023, the total amount of cross-border RMB transactions for goods trade reached 10.7 trillion yuan, a year-on-year increase of 34.9%. This accounted for 24.8% of the total cross-border payment amount in both foreign and domestic currencies, up 6.6 percentage points from 2022.

Among these, the total RMB cross-border payment amount for general trade was 6.8 trillion yuan, up 34.8% year-on-year; for processing trade, it was 1.6 trillion yuan, up 8.9%. From January to August 2024, the total RMB cross-border payment for goods trade reached 7.9 trillion yuan, a year-on-year increase of 16.8%, accounting for 26.5% of the total cross-border payment amount, up 1.7 percentage points from the entire year of 2023.

At the same time, China has increased its efforts to replace the dollar in international trade.

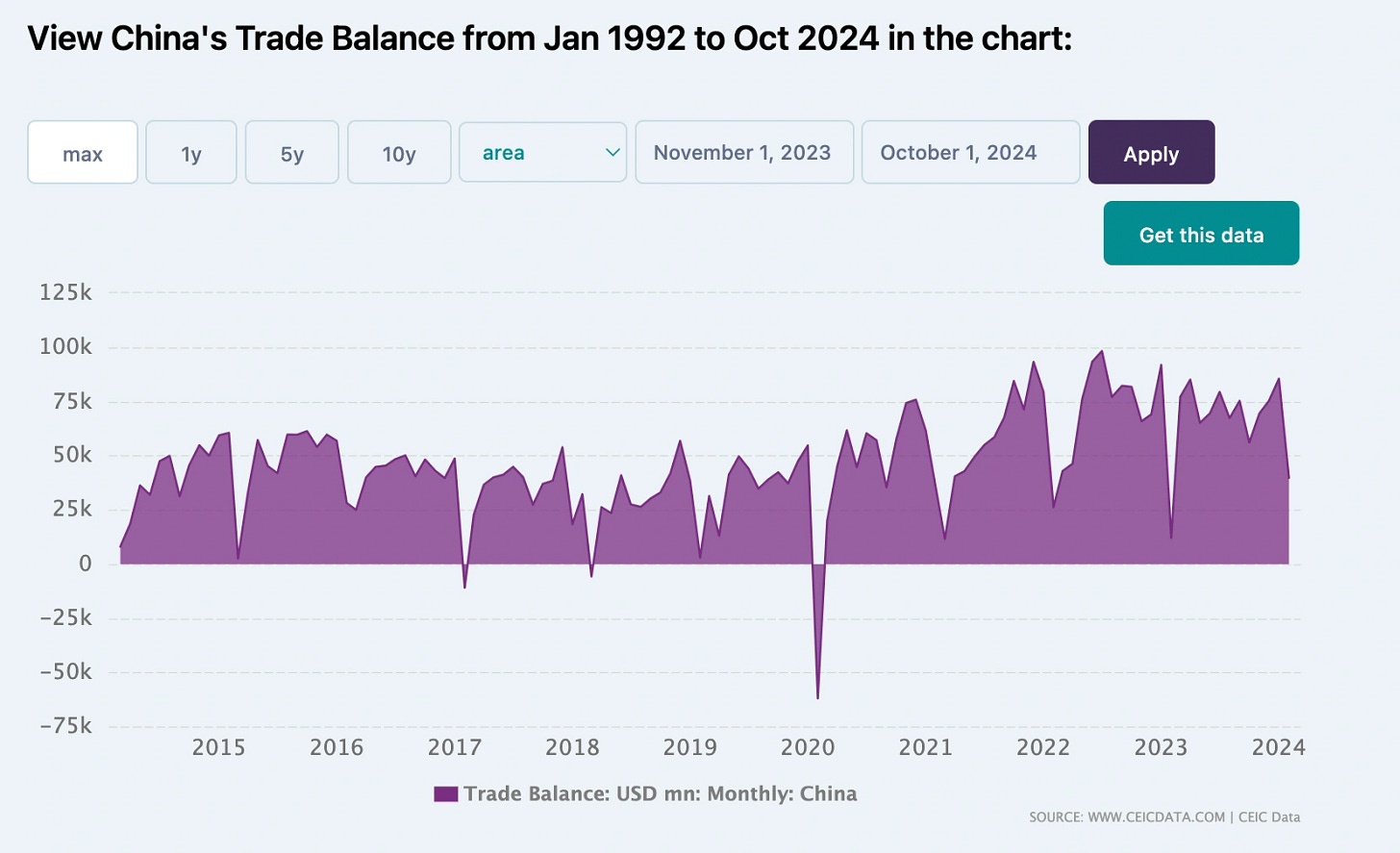

Looking at the trade balance compared to the first trade war in 2017, China’s trade surplus has not only not diminished but has actually expanded. China now has plenty of dollars and significantly improved its adjustment capacity compared to 2017, with overall export amounts also much higher than in 2017.

Currently, there are two directions: one is debt replacement for developing countries, and the other is developing trade with developing countries.

Debt Substitution for Developing Countries

Currently, although China has ample foreign exchange reserves, most developing countries face ongoing deficits and significant dollar debts.

While some in China joke that the dollar is just green paper, for these countries, it represents real debt. They are burdened by dollar liabilities, especially as U.S. treasury rates rise, compounded by the tidal effects of the dollar, which creates a heavy burden for many nations.

Keep reading with a 7-day free trial

Subscribe to China Academy Newsletter to keep reading this post and get 7 days of free access to the full post archives.